Tax Credits For Ac Units 2025. In 2025, homeowners interested in upgrading their air conditioning (ac) units can potentially benefit from various tax credits aimed at promoting energy efficiency and reducing carbon. What you need to know about 2025 federal tax credits and rebates for hvac upgrades!

1 for a limited time only, homeowners may qualify for a cool cash rebate by purchasing qualifying carrier equipment between september 11 and november 18, 2025. In addition to tax credits for qualifying ac or heat pump installation, you can also get a tax credit for installing a new boiler, furnace, water.

Tax Credits Renewal S. Smith Accounting, In 2025, you can claim 30% of the costs for all qualifying hvac systems installed during the year as tax credits. This tax credit program lasts until december 31, 2032.

HMRC reveals details of R&D credits antifraud campaign Tax Tips G&T, Learn which tax incentives and tax credits are changing or becoming available in 2025. Provides a tax credit to homeowners equal to 30% of installation costs for the highest efficiency tier products, up to a maximum of $600 for qualified air conditioners and furnaces, and a maximum.

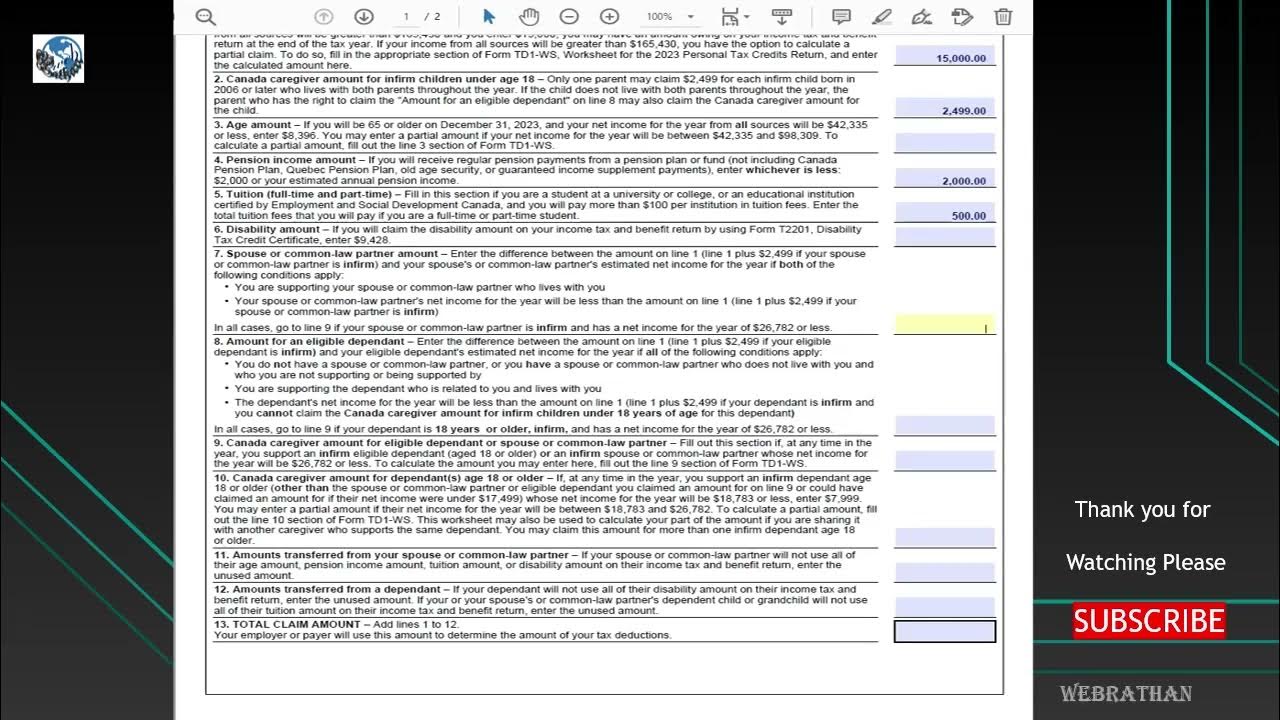

2025 Ontario Tax Form Printable Forms Free Online, For example, if your heat pump is deployed in 2025, you can redeem your credit when you submit your taxes. In 2025, homeowners interested in upgrading their air conditioning (ac) units can potentially benefit from various tax credits aimed at promoting energy efficiency and reducing carbon.

Canada to Set up Tax Credits for Clean Tech, Launch Growth Fund, For example, if your heat pump is deployed in 2025, you can redeem your credit when you submit your taxes. This program allows georgia homeowners to claim a tax credit equal to 30% of the total cost of qualified hvac equipment, with some limitations.

20 Billion in Tax Credits Fails to Increase College Attendance The, 200 heating air conditioning water heaters insulation windows doors kitchen laundry. The good news is that there are several ways you can save when installing a new hvac unit, and this guide will explain all of the hvac tax credits and rebates available to.

What is a Tax Credit? Tax Credits Explained, What you need to know about 2025 federal tax credits and rebates for hvac upgrades! The maximum tax credit amount you can get back is $3,200/year.

Mastering Your Taxes 2025 W4 Form Explained 2025 AtOnce, This program allows georgia homeowners to claim a tax credit equal to 30% of the total cost of qualified hvac equipment, with some limitations. What you need to know about 2025 federal tax credits and rebates for hvac upgrades!

Federal Tax Credits To Support Affordable Housing In Detroit Friedman, This program allows georgia homeowners to claim a tax credit equal to 30% of the total cost of qualified hvac equipment, with some limitations. Provides a tax credit to homeowners equal to 30% of installation costs for the highest efficiency tier products, up to a maximum of $600 for qualified air conditioners and.

Tax Credits To Claim in 2025 ProFed Credit Union, 30% of cost up to $600 each for a qualified air conditioner or gas furnace, with an annual cap of $1,200. Tax credits are applied to the tax year you install the heat pump.

Opinion Here's how San Diegans can access earned tax credits, 200 heating air conditioning water heaters insulation windows doors kitchen laundry. To qualify for maximum federal tax credits in 2025, your ductless mini split must meet new minimum efficiency ratings which have been raised versus last year:

In 2025, you can claim 30% of the costs for all qualifying hvac systems installed during the year as tax credits.

For system combinations below, pair the outdoor units with eligible furnace or eligible air handler and trane smart thermostat.

The American Rodeo 2025 Winners. Nevertheless, in the culmination of the american rodeo, a total of eight divisional champions were…

December 2025 Max. A new max 2025 preview has arrived and features your first look at new footage from highly…

Florida Snow 2025. 21, 2025, and runs through march 19, 2025. This was achieved following the recent series of winter…